Union Membership

Understanding the Costs of Membership

Union membership is not free; unions want to be paid for their services. Unions can determine what their members pay for things including initiation fees, monthly union dues, special assessments and even fines for breaking union rules. This is true even in a Right-to-Work state.

Understanding Right-to-Work vs. Non-Right-to-Work

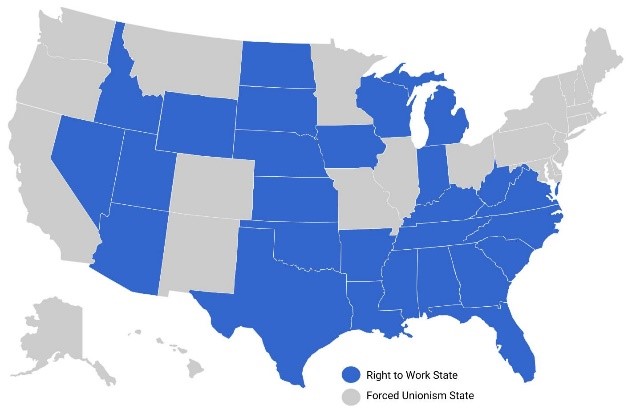

In non-Right-to-Work states (i.e., Missouri, Illinois), unions can demand that employees be required to pay union dues in order to keep their jobs through union security provisions in collective bargaining agreements. As the map indicates, there are currently 23 states (colored in grey) in which employees can be forced to pay union dues as a “condition of employment.”

In Right-to-Work states (colored in blue), employees cannot be forced to pay union dues as a condition of their employment.

However, in both Non-Right-to-Work and Right-to-Work states, unions can exclude non-members (those who don’t pay membership dues) from participating in union business (i.e., running for elected office, participating in union meetings, voting on contracts, participating in strike votes, etc.).

Why is Missouri still colored in grey?

In Missouri, a Right-to-Work law has been passed but is not currently effective due to a pending challenge. What does that mean today? Today, Missouri employees who are required to pay dues to a union as part of a collective bargaining agreement can be fired, at the union’s request, if the employee does not pay those dues.

How Much Could a Union Expect in Monthly Dues

Each union is allowed to determine how much to charge their members in fees, dues and/or assessments.

The NNOC, in a letter dated September 1, 2015 to SSM Health Saint Louis University Hospital, instructed the hospital to calculate dues on a biweekly payroll schedule as follows:

“Nurses who are paid for more than 24 hours per two–week pay period should be charged 1.015 times their Base Hourly Rate, up to a maximum of $62.45.”

“Nurses who are paid 24 hours or fewer per two-week pay period should be charged 1.015 times their base hourly rate or $31.23, whichever amount is less.”

Click here to see the NNOC’s letter.

You can certainly calculate what the NNOC may ask of you, if you were to become their member and they used the same dues formula that they use for their members at SSM Health Saint Louis University Hospital.

What would the opportunity to have all RNs at your hospital paying dues look like to the NNOC. Below is a ballpark estimate of what the dues opportunity for the NNOC could look like at a hospital with 500 RNs if they charge the same amount of dues as above. (Of course, if your hospital has more RNs, then the total amount the union could collect would be much more.)

Assume the average Registered Nurse earns $30 per hour. Assume there are approximately 400 nurses working more than 24 hours per two-week pay period, and there are approximately 100 nurses working 24 or less hours per two-week pay period. The table below shows what the average nurse working more than 24 hours per pay period could be expected to pay in union dues (per month, per year and over the life of a typical three-year contract):

|

Dues Per Average |

Dues Per Average |

Total Dues Payments, Per Average FT Nurse Over a Typical 3-Year Contract |

|

$ 60.90 |

$ 730.80 |

$ 2,192.40 |

As you can see, union dues can really add up. In fact, the table below shows how much money the NNOC could potentially collect from all nurses, based on the example above, over the life of a typical three-year contract.

|

All Nurses Dues Payments Year #1 |

All Nurses Dues Payments in Year #2 |

All Nurses Dues Payments Year #3 |

Total Nurses Dues Payments, Over a Typical 3-Year Contract |

|

$ 365,400 |

$ 365,400 |

$ 365,400 |

$ 1,096,200 |

Did you notice? We didn’t even factor in pay increases. When a pay increase occurs, that new base rate is used to multiply by 1.015 each pay period.

You should make sure that you ask the union representatives to put in writing how much they would expect you to pay in dues – and explain what would happen if you decide you don’t feel you should have to pay. View more information about membership dues.

Understanding How Unions Spend Dues Income

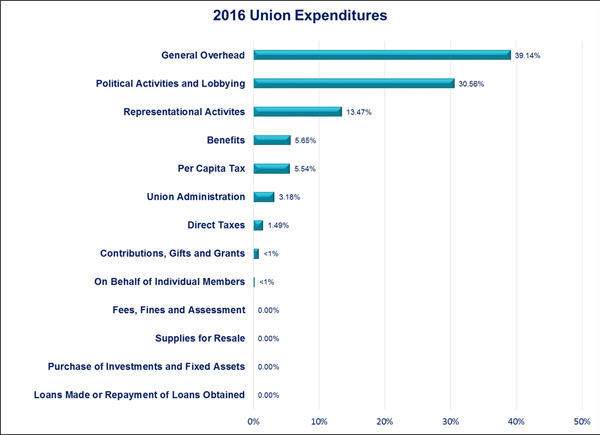

All unions are required to file annual financial disclosure forms with the U.S. Department of Labor. The disclosure form is called an LM-2 and provides important information about how much money the union collects from members and how that money is spent.

All unions are required to file annual financial disclosure forms with the U.S. Department of Labor. The disclosure form is called an LM-2 and provides important information about how much money the union collects from members and how that money is spent.

In 2016, the NNU reported total dues income of $28,240,884, and in the same year spent a total of $27,317,571.

The NNU itemizes expenditures for things like representational activities, political activities and lobbying, general overhead, and union administration.

These expenditures include payments for salaries, benefits and other perks for the union's officers and employees. They also include payments for political donations and lobbying to advance the objectives of the union and causes it supports.

The NNU’s constitution gives union leaders the power to decide how union member’s dues are spent.

Understanding how much money the NNU collects each year, and how they decide to spend their members’ dues is important information to help you make an informed decision about the union. View more information about union finances.

Download a copy of the NNU Form LM-2

Understanding the Obligations of Membership

Having a union in the workplace can come with intangible consequences like tension in the work place, adversarial relationships, and a loss of teamwork. Individuality and the right to speak for yourself could be limited. Instead of dealing directly with your supervisor, your union representative may look at a collective bargaining agreement for a one-size-fits-all answer. It’s hard to predict what may happen, but workplace culture and relationships may not be the same as they were before union representation.

When employees elect a union as their collective bargaining representative and become a member of the union, they are expected to abide by all the rules contained in the union’s constitution. NNOC members, as an affiliate of the NNU, are bound to follow the rules in the NNU’s Constitution. This document spells out the rules of membership and allows union officials to exert some control over their members.

Important topics covered in the NNU”s Constitution include the following:

- Section II, Membership (pages 2-3): Any nurse who is a member in good standing of the NNOC (i.e., an affiliate) is also a member of the NNU.

- Section II, Membership (page 3-4): Provides the definition of a dues-paying “member in good standing.” To be in good standing, a nurse cannot be “in arrears” in the payment of dues or assessments. This section also explains that a membership may be “terminated” for non-payment of dues or assessments.

- Section II, Membership (page 4): All NNU members are obligated to comply with the NNU’s Constitution and NNU policies.

- Section III, Affiliates (page 6): The NNOC is required to ensure that its members are members of the NNU.

- Section IV, Executive Council (page 12-18): Explains the powers and authorities of the Executive Council, Executive Director and Executive Committee with respect to the NNU members.

- Section VII, Dues Assessments and Finances (page 27): The NNU’s Dues Policy establishes an annual rate for NNU Affiliates “per capita” dues (what the NNOC must pay to the NNU per member) and it contains “an annual automatic escalator for payments on behalf of NNU Affiliate members.”

- Section VII, Dues Assessments and Finances (page 27): The NNU can levy a special assessment on all members and the NNOC is responsible for collecting the special assessments from its members and sending it to the NNU.

- NNU Dues Policy (page 37): The per capita dues that an affiliate (NNOC) must pay to the NNU for each member was $136.40 in 2010. Beginning in 2011, the amount began automatically increasing by 2.5% each year.

To assist you in considering the obligations of union membership, we have included a link to the NNU Constitution filed in 2014 with the Department of Labor.